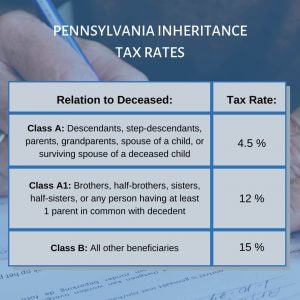

People that live in Pennsylvania should know that PA is one of five states that tax individuals on death. The tax rates start out at zero between husband and wife, 4.5% for lineal descendants (your children), 12% for consanguinity (which are cousins, nieces and nephews), and 15% for people who are unrelated to you.

For example, if you have $20,000 in your name alone, and through your will, you give it to a friend of yours, it would be taxed at 15% or they would owe $3,000 in taxes. If you trust your friend and you put your friend’s name on that $20,000 with you (you make the asset joint), it will cut the bill down to $10,000 at 15% or $1500. It is important to make an asset joint; you can cut the tax in half that way.

The other way to avoid inheritance tax is to make periodic gifts to get assets out of your name. If you still want to maintain control of it through an individual trustee, you can create an irrevocable trust, which will pass it tax-free. That type of trust must be distinguished from what is known as a revocable trust in which there is still inheritance tax.

Folks also have to remember though, that inheritance tax isn’t always bad…

For example, once you die with an asset and pay the inheritance tax, you get what’s known as a stepped-up basis. For example, if you bought Walt Disney stock for $10,000 and held onto it for your lifetime, it’s now worth $100,000. If you die with it and bequeath it to your daughter, the tax rate would be at 4.5% on $100,000 which is $4,500. If you had turned around and gifted that to your daughter, she would have had a basis of only $10,000. And if she sold it for $100k, she would have had a $90,000 gain to the IRS which is taxable, or capital gains rate to whatever it may be.

So in reality, it wasn’t too bad paying inheritance tax in that scenario. You always have to look at the asset whether it’s an appreciating asset, or one that has always maintained its principal balance such as cash when making these decisions.

If you need any help with these decisions, please contact our firm with any questions.