Did you know that Pennsylvania is one of five states that tax individuals on death? If you are a Pennsylvania resident, this is something that you need to be aware of.

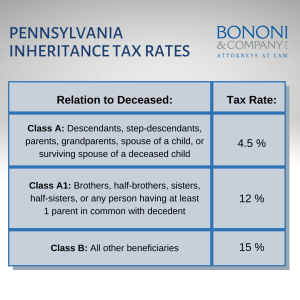

The tax rates begin at zero for husband and wife, 4.5 percent for lineal descendants (children), 12 percent for consanguinity (cousins, nieces, and nephews), and 15% for people who are not related to you.

How To Avoid Inheritance Tax

One way to avoid inheritance tax in PA is to make an asset joint. For example, if you have $30,000 in your name alone, and through your will, you give it to a friend of yours, it would be taxed at 15% or they would owe $4,500 in taxes. If you trust your friend and you put your friend’s name on that $30,000 with you (you make the asset joint), it will cut the bill down to $15,000 at 15% or $2250. It is important to make an asset joint; you can cut the tax in half that way.

Making periodic donations to get assets out of your name is another approach to avoid this tax. If you still wish to keep control of it through a single trustee, you may set up an irrevocable trust that will pass it tax-free. That type of trust should be distinguished from a revocable trust, which is still subject to inheritance tax.

Questions about inheritance tax? Contact our staff of experienced legal and financial professionals today at 724-832-2499.